EXECUTION VERSION

AMENDED AND RESTATED LIMITED GUARANTEE

LIMITED GUARANTEE, dated as of February 18, 2019 (this “Limited Guarantee”), by Dongfeng Asset Management Co. Ltd. (the “Guarantor”), in favor of eHi Car Services Limited, an exempted company with limited liability incorporated under the Laws of the Cayman Islands (the “Guaranteed Party”), which amends and restates in its entirety that certain Limited Guarantee, dated as of April 6, 2018 (the “Original Limited Guarantee”), by the Guarantor in favor of the Guaranteed Party.

1. GUARANTEE.

(a) To induce the Guaranteed Party to enter into that certain Amended and Restated Agreement and Plan of Merger, dated as of February 18, 2019 (as amended, restated, supplemented or otherwise modified from time to time, the “Merger Agreement”), among the Guaranteed Party, Teamsport Parent Limited (“Parent”) and Teamsport Bidco Limited (“Merger Sub”), pursuant to which Merger Sub will merge with and into the Guaranteed Party (the “Merger”), with the Guaranteed Party continuing as the surviving company in the Merger and a wholly-owned Subsidiary of Parent, the Guarantor, intending to be legally bound, hereby absolutely, irrevocably and unconditionally guarantees to the Guaranteed Party, on the terms and conditions set forth herein, the due and punctual payment when due of 3.27% (the “Guaranteed Percentage”) of the payment obligations of Parent with respect to (i) the Parent Termination Fee pursuant to Section 8.06(b) of the Merger Agreement and (ii) any amounts payable pursuant to Section 8.06(d) of the Merger Agreement, in each case of clauses (i) and (ii), if and to the extent those obligations become payable under the Merger Agreement, subject to the terms and limitations of Section 8.06(f) of the Merger Agreement (the “Obligations”); provided that in no event shall the Guarantor’s aggregate liability under this Limited Guarantee exceed US$919,696.75 less the amount equal to the product of (A) any amount actually paid by or on behalf of Parent to the Guaranteed Party in respect of the Obligations multiplied by (B) the Guaranteed Percentage (the “Cap”), it being understood that this Limited Guarantee may not be enforced against the Guarantor without giving effect to the Cap (and to the provisions of Section 8 and Section 9). The Guaranteed Party hereby agrees that in no event shall the Guarantor be required to pay to any person under, in respect of, or in connection with, this Limited Guarantee, an amount in excess of the Cap or the Guaranteed Percentage of the Obligations, and that the Guarantor shall not have any obligation or liability to the Guaranteed Party relating to, arising out of or in connection with, this Limited Guarantee or the Merger Agreement other than as expressly set forth herein. The Guaranteed Party further acknowledges that in the event that Parent has satisfied a portion but not all of the Obligations, payment of the Guaranteed Percentage of the unsatisfied Obligations by the Guarantor (or by any other person, including Parent or Merger Sub, on behalf of the Guarantor) shall constitute satisfaction in full of the Guarantor’s obligation to the Guaranteed Party with respect thereto. This Limited Guarantee may be enforced for the payment of money only. All payments hereunder shall be made in lawful money of the United States, or other currencies if otherwise agreed by the parties hereto, in immediately available funds. Concurrently with the delivery of this Limited Guarantee, each party set forth on Schedule A (each, an “Other Guarantor”) is also entering into a limited guarantee or an amended and restated limited guarantee, as applicable, substantially identical to this Limited Guarantee (each, an “Other Guarantee”) with the Guaranteed Party. This Limited Guarantee shall become effective upon the substantially simultaneous signing of the Other Guarantees. Each capitalized term used and not defined herein shall have the meaning ascribed to it in the Merger Agreement, except as otherwise provided herein.

| -1- |

(b) All payments made by the Guarantor pursuant to this Limited Guarantee shall be free and clear of any deduction, offset, defense, claim or counterclaim of any kind. If Parent fails to pay or cause to be paid the Obligations as and when due pursuant to Section 8.06(b) or Section 8.06(d) of the Merger Agreement, as applicable, and subject to the other relevant terms and limitations of the Merger Agreement, then the Guarantor’s liabilities to the Guaranteed Party hereunder in respect of the Obligations shall, upon the Guaranteed Party’s demand, become immediately due and payable and the Guaranteed Party may at any time and from time to time, at the Guaranteed Party’s option, and so long as Parent remains in breach of the Obligations, take any and all actions available hereunder or under applicable Law to collect the Obligations from the Guarantor, subject to the Cap.

(c) The Guarantor agrees to pay on demand all reasonable and documented out-of-pocket expenses (including reasonable fees and expenses of counsel) incurred by the Guaranteed Party in connection with the enforcement of its rights hereunder in the event that (i) the Guarantor asserts in any arbitration, litigation or other proceeding that this Limited Guarantee is illegal, invalid or unenforceable in accordance with its terms and the Guaranteed Party prevails in such arbitration, litigation or other proceeding or (ii) the Guarantor fails or refuses to make any payment to the Guaranteed Party hereunder when due and payable and it is determined judicially or by arbitration that the Guarantor is required to make such payment hereunder.

(d) In furtherance of the foregoing, the Guarantor acknowledges that the Guaranteed Party may, in its sole discretion, bring and prosecute a separate action or actions against the Guarantor for the full amount of the Guarantor’s Guaranteed Percentage of the Obligations (subject to the Cap), regardless of whether an action is brought against Parent, Merger Sub or any Other Guarantor or whether Parent, Merger Sub or any Other Guarantor is joined in any such action or actions.

2. NATURE OF GUARANTEE.

The Guaranteed Party shall not be obligated to file any claim relating to the Obligations in the event that Parent or Merger Sub becomes subject to a bankruptcy, reorganization or similar proceeding, and the failure of the Guaranteed Party to so file shall not affect the Guarantor’s obligations hereunder. Subject to the terms hereof, the Guarantor’s liability hereunder is absolute, unconditional, irrevocable and continuing irrespective of any modification, amendment or waiver of or any consent to departure from the Merger Agreement that may be agreed to by Parent or Merger Sub (except where this Limited Guarantee is terminated in accordance with Section 8). In the event that any payment to the Guaranteed Party in respect of the Obligations is rescinded or must otherwise be returned for any reason whatsoever, the Guarantor shall remain liable hereunder with respect to its Guaranteed Percentage of the Obligations (subject to the Cap) as if such payment had not been made by the Guarantor. This Limited Guarantee is an unconditional guarantee of payment and not of collection. This Limited Guarantee is a primary obligation of the Guarantor and is not merely the creation of a surety relationship, and the Guaranteed Party shall not be required to proceed against Parent or Merger Sub first before proceeding against the Guarantor hereunder.

| -2- |

3. CHANGES IN OBLIGATIONS, CERTAIN WAIVERS.

(a) The Guarantor agrees that the Guaranteed Party may at any time and from time to time, without notice to or further consent of the Guarantor, extend the time of payment of any of the Obligations, and may also make any agreement with Parent and/or Merger Sub for the extension, renewal, payment, compromise, discharge or release thereof, in whole or in part, or for any modification of the terms thereof or of any agreement between the Guaranteed Party and Parent or Merger Sub without in any way impairing or affecting the Guarantor’s obligations under this Limited Guarantee. The Guarantor agrees that its obligations hereunder shall not be released or discharged (except in the case where this Limited Guarantee is terminated in accordance with Section 8), in whole or in part, or otherwise affected by (i) the failure or delay on the part of the Guaranteed Party to assert any claim or demand or to enforce any right or remedy against Parent, Merger Sub or any Other Guarantor, (ii) any change in the time, place or manner of payment of the Obligations or any rescission, waiver, compromise, consolidation or other amendment or modification of any of the terms or provisions of the Merger Agreement made in accordance with the terms thereof or any agreement evidencing, securing or otherwise executed in connection with the Obligations (in each case, except in the event of any amendment to the circumstances under which the Obligations are payable), (iii) any legal or equitable discharge or release (other than a discharge or release as a result of payment in full of the Guaranteed Percentage of the Obligations in accordance with their terms, a discharge or release of Parent and/or Merger Sub with respect to the Obligations under the Merger Agreement, or as a result of defenses to the payment of the Obligations that would be available to Parent and/or Merger Sub under the Merger Agreement) of any person now or hereafter liable with respect to any of the Obligations or otherwise interested in the Transactions, (iv) any change in the corporate existence, structure or ownership of Parent, Merger Sub or any other person now or hereafter liable with respect to any of the Obligations or otherwise interested in the Transactions, (v) any insolvency, bankruptcy, reorganization or other similar proceeding affecting Parent, Merger Sub or any other person now or hereafter liable with respect to any of the Obligations or otherwise interested in the Transactions, (vi) the existence of any claim, set-off or other right which the Guarantor may have at any time against Parent or Merger Sub or the Guaranteed Party, whether in connection with the Obligations or otherwise, or (vii) the adequacy of any other means the Guaranteed Party may have of obtaining payment of the Obligations.

(b) To the fullest extent permitted by Law, the Guarantor hereby expressly waives any and all rights or defenses arising by reason of any Law that would otherwise require any election of remedies by the Guaranteed Party. The Guarantor waives promptness, diligence, notice of the acceptance of this Limited Guarantee and of the Obligations, presentment, demand for payment, notice of non-performance, default, dishonor and protest, notice of any of the Obligations incurred and all other notices of any kind (other than notices to Parent and/or Merger Sub pursuant to the Merger Agreement or as expressly required pursuant to this Limited Guarantee), all defenses that may be available by virtue of any valuation, stay, moratorium Law or other similar Law now or hereafter in effect, any right to require the marshalling of assets of Parent or Merger Sub or any other person interested in the Transactions (including any Other Guarantor), and all suretyship defenses generally (other than defenses to the payment of the Obligations that are available to Parent and/or Merger Sub under the Merger Agreement or a breach by the Guaranteed Party of this Limited Guarantee). The Guarantor acknowledges that it will receive substantial direct and indirect benefits from the Transactions and that the waivers set forth in this Limited Guarantee are knowingly made in contemplation of such benefits.

| -3- |

(c) The Guaranteed Party hereby covenants and agrees that it shall not institute, directly or indirectly, and shall cause its Subsidiaries and its Affiliates not to institute, directly or indirectly, any proceeding or bring any other claim (whether in tort, contract or otherwise) arising under, or in connection with, the Merger Agreement, the Transactions, or the Contribution and Support Agreement, against the Guarantor or any Non-Recourse Party (as defined below), except for claims against the Guarantor under this Limited Guarantee (subject to the limitations set forth herein) and against each Other Guarantor under its Other Guarantee (subject to the limitations set forth therein). The Guarantor hereby covenants and agrees that it shall not institute, directly or indirectly, and shall cause its Subsidiaries and its Affiliates not to institute, directly or indirectly, any proceeding asserting or assert as a defense in any proceeding, subject to clause (ii) of the last sentence of clause (d) hereof, that this Limited Guarantee is illegal, invalid or unenforceable in accordance with its terms.

(d) The Guarantor hereby unconditionally and irrevocably waives and agrees not to exercise any rights that it may now have or hereafter acquire against Parent or Merger Sub that arise from the existence, payment, performance, or enforcement of the Guarantor’s obligations under or in respect of this Limited Guarantee (subject to the Cap) or any other agreement in connection therewith, including any right of subrogation, reimbursement, exoneration, contribution or indemnification and any right to participate in any claim or remedy of the Guaranteed Party against Parent, Merger Sub or any Other Guarantor, whether or not such claim, remedy or right arises in equity or under contract, statute or common Law, including the right to take or receive from Parent, Merger Sub or any Other Guarantor, directly or indirectly, in cash or other property or by set-off or in any other manner, payment or security on account of such claim, remedy or right, unless and until all of the Guaranteed Percentage of the Obligations and all other amounts payable under this Limited Guarantee shall have been paid in full in immediately available funds. If any amount shall be paid to the Guarantor in violation of the immediately preceding sentence at any time prior to the payment in full in immediately available funds of the Guaranteed Percentage of the Obligations and all other amounts payable under this Limited Guarantee (subject to the Cap), such amount shall be received and held in trust for the benefit of the Guaranteed Party, shall be segregated from other property and funds of the Guarantor and shall forthwith be paid or delivered to the Guaranteed Party in the same form as so received (with any necessary endorsement or assignment) to be credited and applied to the Obligations and all other amounts payable under this Limited Guarantee, whether matured or unmatured, or to be held as collateral for the Guaranteed Percentage of the Obligations or other amounts payable under this Limited Guarantee thereafter arising. Notwithstanding anything to the contrary contained in this Limited Guarantee (but subject to Section 3(a)), the Guaranteed Party hereby agrees that: (i) to the extent Parent and Merger Sub are relieved of any of their obligations with respect to the Parent Termination Fee, the Guarantor shall be similarly relieved of its Guaranteed Percentage of such obligations under this Limited Guarantee, and (ii) the Guarantor shall have all defenses to the payment of its obligations under this Limited Guarantee (which in any event shall be subject to the Cap) that would be available to Parent and/or Merger Sub under the Merger Agreement with respect to the Obligations.

| -4- |

4. NO WAIVER; CUMULATIVE RIGHTS.

No failure on the part of the Guaranteed Party to exercise, and no delay in exercising, any right, remedy or power hereunder shall operate as a waiver thereof; nor shall any single or partial exercise by the Guaranteed Party of any right, remedy or power hereunder preclude any other or future exercise of any right, remedy or power hereunder. Each and every right, remedy and power hereby granted to the Guaranteed Party or allowed it by Law shall be cumulative and not exclusive of any other, and may be exercised by the Guaranteed Party at any time or from time to time. The Guaranteed Party shall not have any obligation to proceed at any time or in any manner against, or exhaust any or all of the Guaranteed Party’s rights against, Parent or any other person (including any Other Guarantor) liable for any of the Obligations prior to proceeding against the Guarantor hereunder, and the failure by the Guaranteed Party to pursue rights or remedies against Parent or Merger Sub (or any Other Guarantor) shall not relieve the Guarantor of any liability hereunder, and shall not impair or affect the rights and remedies, whether express, implied or available as a matter of Law, of the Guaranteed Party.

5. REPRESENTATIONS AND WARRANTIES.

The Guarantor hereby represents and warrants that:

(a) the execution, delivery and performance of this Limited Guarantee have been duly authorized by all necessary action on the Guarantor’s part and do not contravene any Law, regulation, rule, decree, order, judgment or contractual restriction binding on the Guarantor or its assets or properties;

(b) except as is not, individually or in the aggregate, reasonably likely to impair or delay the Guarantor’s performance of its obligations hereunder in any material respect, all consents, approvals, authorizations, permits of, filings with and notifications to, any governmental authority necessary for the due execution, delivery and performance of this Limited Guarantee by the Guarantor have been obtained or made and all conditions thereof have been duly complied with;

(c) assuming due execution and delivery of this Limited Guarantee and the Merger Agreement by the Guaranteed Party, this Limited Guarantee constitutes a legal, valid and binding obligation of the Guarantor enforceable against the Guarantor in accordance with its terms, subject to (i) the effects of bankruptcy, insolvency, fraudulent conveyance, reorganization, moratorium or other similar Laws affecting creditors’ rights generally, and (ii) general equitable principles (whether considered in a proceeding in equity or at Law); and

(d) the Guarantor has the financial capacity to pay and perform its obligations under this Limited Guarantee, and all funds necessary for the Guarantor to fulfill its obligations under this Limited Guarantee shall be available to the Guarantor (or its assignee pursuant to Section 6) for so long as this Limited Guarantee shall remain in effect in accordance with Section 8.

6. NO ASSIGNMENT.

Neither the Guarantor nor the Guaranteed Party may assign or delegate (whether by operation of Law, merger, consolidation or otherwise) its rights, interests or obligations hereunder to any other person, in whole or in part, without the prior written consent of the other party hereto , except that the Guarantor may assign or delegate all or part of its rights, interests and obligations hereunder, without the prior written consent of the Guaranteed Party, to (a) any Other Guarantor or (b) any of the Guarantor’s Affiliates, or any other investment fund or investment vehicle advised or managed by the Guarantor or such Affiliate, to the extent that such person has been allocated, in accordance with the Equity Commitment Letter, all or a portion of the Guarantor’s investment commitment to Holdco; provided that any such assignment or delegation shall not relieve the Guarantor of its obligations hereunder to the extent not performed by such Other Guarantor, Affiliate, fund or investment vehicle. Any assignment or delegation in violation of this Section 6 shall be null and void and of no force and effect.

| -5- |

7. NOTICES.

All notices, requests, claims, demands and other communications hereunder shall be given by the means specified in the Merger Agreement (and shall be deemed given as specified therein), as follows:

if to the Guarantor:

Dongfeng Asset Management Co. Ltd.

Special No.1 DongFeng Road

WuHan Economic&Technical Development Zone

WuHan, HuBei Province, PRC, 430056

Attention: Zhang Xiao

Wang You

Email: zhxiao@dfmc.com.cn

wangy@dfmc.com.cn

with a copy to:

Sheppard,

Mullin, Richter & Hampton LLP

26th Floor, Wheelock Square

1717 Nanjing Road West

Shanghai, 200040

People’s Republic of China

Attention: Don S. Williams

Facsimile: +86 21 2321 6001

Email: dwilliams@sheppardmullin.com

If to the Guaranteed Party, as provided in the Merger Agreement.

8. CONTINUING GUARANTEE.

(a) Subject to the last sentence of Section 3(d), this Limited Guarantee may not be revoked or terminated and shall remain in full force and effect and shall be binding on the Guarantor, its successors and assigns until the earliest to occur of (i) all of the Obligations (subject to the Cap) payable under this Limited Guarantee having been paid in full by the Guarantor, (ii) the Effective Time, (iii) the termination of the Merger Agreement in accordance with its terms by mutual consent of Parent and the Guaranteed Party or under circumstances in which Parent and Merger Sub would not be obligated to pay the Parent Termination Fee under Section 8.06(b) of the Merger Agreement and (iv) ninety (90) days after any termination of the Merger Agreement in accordance with its terms under circumstances in which Parent and Merger Sub would be obligated to pay the Parent Termination Fee under Section 8.06(b) of the Merger Agreement if the Guaranteed Party has not presented a bona fide written claim for payment of any Obligation to the Guarantor by such 90th day; provided that if the Guaranteed Party has presented such claim to the Guarantor by such date, this Limited Guarantee shall terminate upon the date such claim is finally satisfied or otherwise resolved by agreement of the parties hereto or pursuant to Section 10. The Guarantor shall have no further obligations under this Limited Guarantee following termination in accordance with this Section 8.

| -6- |

(b) Notwithstanding the foregoing, in the event that the Guaranteed Party or any of its Affiliates asserts in any litigation or other proceeding relating to this Limited Guarantee (i) that the provisions of Section 1 limiting the Guarantor’s maximum aggregate liability to the Cap or that the provisions of Sections 8, 9, 10, 13, 14 or the last sentence of Section 3(d) are illegal, invalid or unenforceable in whole or in part, (ii) that the Guarantor is liable in excess of or to a greater extent than the Guaranteed Percentage of the Obligations or the Cap, or (iii) any theory of liability against the Guarantor or any Non-Recourse Parties (as defined below) with respect to the Merger Agreement, the Contribution and Support Agreement or the Transactions or the liability of the Guarantor under this Limited Guarantee (as limited by the provisions hereof, including Section 1), other than the Retained Claims (as defined below), then (x) the obligations of the Guarantor under this Limited Guarantee shall terminate ab initio and shall thereupon be null and void, (y) if the Guarantor has previously made any payments under this Limited Guarantee, it shall be entitled to recover such payments from the Guaranteed Party, and (z) neither the Guarantor nor any Non-Recourse Parties shall have any liability whatsoever (whether at Law or in equity, whether sounding in contract, tort, statute or otherwise) to the Guaranteed Party or any of its Affiliates with respect to the Merger Agreement, the Contribution and Support Agreement, the Transactions, this Limited Guarantee or any other agreement or instrument delivered in connection with this Limited Guarantee or the Merger Agreement (including the Equity Commitment Letters and the Contribution and Support Agreement).

9. NO RECOURSE.

Notwithstanding anything to the contrary that may be expressed or implied in this Limited Guarantee or any document or instrument delivered in connection herewith, by its acceptance of the benefits of this Limited Guarantee, the Guaranteed Party agrees and acknowledges that (a) no person other than the Guarantor has any obligations hereunder, notwithstanding that the Guarantor is a limited liability company, (b) the Guaranteed Party has no right of recovery under this Limited Guarantee or in any document or instrument delivered in connection herewith, or for any claim based on, in respect of, or by reason of, such obligations or their creation, against, and no personal liability shall attach to, the former, current or future equity holders, controlling persons, directors, officers, employees, agents, advisors, representatives, Affiliates (other than any assignee under Section 6), members, managers, or general or limited partners of any of the Guarantor, Parent, Merger Sub or any Other Guarantor, or any former, current or future equity holder, controlling person, director, officer, employee, general or limited partner, member, manager, Affiliate (other than any assignee under Section 6), agent, advisor, or representative of any of the foregoing (each a “Non-Recourse Party”), through Parent, Merger Sub or otherwise, whether by or through attempted piercing of the corporate (or limited partnership or limited liability company) veil, by or through theories of agency, alter ego, unfairness, undercapitalization or single business enterprise, by or through a claim by or on behalf of Parent and/or Merger Sub against any Non-Recourse Party (including any claim to enforce the Contribution and Support Agreement), by the enforcement of any assessment or by any legal or equitable proceeding, by virtue of any statute, regulation or applicable Law, or otherwise, and (c) the only rights of recovery and claims that the Guaranteed Party has in respect of the Merger Agreement or the Transactions are its rights to recover from, and assert claims against, (i) Parent and Merger Sub under and to the extent expressly provided in the Merger Agreement, (ii) the Guarantor (but not any Non-Recourse Party) under and to the extent expressly provided in this Limited Guarantee (subject to the Cap and the other limitations described herein), (iii) the Other Guarantors pursuant to and subject to the limitations set forth in the Other Guarantees and (iv) the Other Guarantors and their respective successors and assigns under the Equity Commitment Letters pursuant to and in accordance with the terms thereof (claims under (i), (ii), (iii) and (iv) collectively, the “Retained Claims”). The Guaranteed Party acknowledges the separate corporate existence of Parent and Merger Sub and acknowledges and agrees that Parent and Merger Sub have no assets other than certain contract rights and cash in a de minimis amount and that no additional funds are expected to be contributed to Parent or Merger Sub unless and until the Closing occurs. Other than as expressly provided under Section 9.08 of the Merger Agreement and Section 4 of the Equity Commitment Letter, recourse against the Guarantor under and pursuant to the terms of this Limited Guarantee and against the Other Guarantors pursuant to the terms of the Other Guarantees shall be the sole and exclusive remedy of the Guaranteed Party and all of its Affiliates against the Guarantor and the Non-Recourse Parties in respect of any liabilities or obligations arising under, or in connection with, this Limited Guarantee, the Other Guarantees, the Merger Agreement, the Equity Commitment Letters, the Contribution and Support Agreement or the Transactions, including by piercing of the corporate (or limited partnership or limited liability company) veil, or by a claim by or on behalf of Parent or Merger Sub. The Guaranteed Party hereby covenants and agrees that, other than with respect to the Retained Claims, it shall not, and it shall cause its Affiliates not to, institute any proceeding or bring any claim in any way under, in connection with or in any manner related to the Transactions (whether at Law or in equity, whether sounding in contract, tort, statute or otherwise) against any Non-Recourse Party. No person other than the Guarantor, the Guaranteed Party and the Non-Recourse Parties shall have any rights or remedies under, in connection with or in any manner related to this Limited Guarantee or the transactions contemplated hereby. Nothing set forth in this Limited Guarantee shall confer or give or shall be construed to confer or give to any person other than the Guaranteed Party (including any person acting in a representative capacity) any rights or remedies against any person including the Guarantor, except as expressly set forth herein. For the avoidance of doubt, none of the Guarantor, Parent, Merger Sub or the Other Guarantors or their respective successors and assigns under the Merger Agreement, the Equity Commitment Letters, this Limited Guarantee or the Other Guarantees shall be Non-Recourse Parties.

| -7- |

10. GOVERNING LAW; DISPUTE RESOLUTION.

(a) This Limited Guarantee shall be interpreted, construed and governed by and in accordance with the Laws of the State of New York without regard to the conflicts of law principles thereof that would subject such matter to the Laws of another jurisdiction other than the State of New York.

(b) Any disputes, actions and proceedings against any party or arising out of or in any way relating to this Limited Guarantee shall be submitted to the Hong Kong International Arbitration Centre (the “HKIAC”) and resolved in accordance with the Arbitration Rules of HKIAC in force at the relevant time (the “Rules”) and as may be amended by this Section 10(b). The place of arbitration shall be Hong Kong. The official language of the arbitration shall be English and the arbitration tribunal shall consist of three arbitrators (each, an “Arbitrator”). The claimant(s), irrespective of number, shall nominate jointly one Arbitrator; the respondent(s), irrespective of number, shall nominate jointly one Arbitrator; and a third Arbitrator will be nominated jointly by the first two Arbitrators and shall serve as chairman of the arbitration tribunal. In the event the claimant(s) or respondent(s) or the first two Arbitrators shall fail to nominate or agree on the joint nomination of an Arbitrator or the third Arbitrator within the time limits specified by the Rules, such Arbitrator shall be appointed promptly by the HKIAC. The arbitration tribunal shall have no authority to award punitive or other punitive-type damages. The award of the arbitration tribunal shall be final and binding upon the disputing parties. Any party to an award may apply to any court of competent jurisdiction for enforcement of such award and, for purposes of the enforcement of such award, the parties irrevocably and unconditionally submit to the jurisdiction of any court of competent jurisdiction and waive any defenses to such enforcement based on lack of personal jurisdiction or inconvenient forum.

(c) Notwithstanding the foregoing, the parties hereto consent to and agree that in addition to any recourse to arbitration as set out in Section 10(b), any party may, to the extent permitted under the Laws of the jurisdiction where application is made, seek an interim injunction from a court or other authority with competent jurisdiction and, notwithstanding that this Agreement is governed by the Laws of the State of New York, a court or authority hearing an application for injunctive relief may apply the procedural Law of the jurisdiction where the court or other authority is located in determining whether to grant the interim injunction. For the avoidance of doubt, this Section 10(c) is only applicable to the seeking of interim injunctions and does not restrict the application of Section 10(b) in any way.

11. COUNTERPARTS.

This Limited Guarantee may be executed in any number of counterparts (including by e-mail of PDF or scanned versions or facsimile), each such counterpart when executed being deemed to be an original instrument, and all such counterparts shall together constitute one and the same agreement.

12. NO THIRD PARTY BENEFICIARIES.

Except as provided in Section 9, the parties hereby agree that their respective representations, warranties and covenants set forth herein are solely for the benefit of the other party hereto, in accordance with and subject to the terms of this Limited Guarantee, and this Limited Guarantee is not intended to, and does not, confer upon any person other than the parties hereto any rights or remedies hereunder, including, the right to rely upon the representations and warranties set forth herein.

13. CONFIDENTIALITY.

This Limited Guarantee shall be treated as confidential and is being provided to the Guaranteed Party solely in connection with the Merger. This Limited Guarantee may not be used, circulated, quoted or otherwise referred to in any document, except with the written consent of the Guarantor; provided that the parties may, without such written consent, disclose the existence and content of this Limited Guarantee to the extent required by Law, the applicable rules of any national securities exchange, in connection with any SEC filings relating to the Merger and in connection with any litigation relating to the Merger, the Merger Agreement or the other Transactions as permitted by or provided in the Merger Agreement and the Guarantor may disclose this Limited Guarantee to any Non-Recourse Party that needs to know of the existence of this Limited Guarantee and is subject to the confidentiality obligations set forth herein.

| -8- |

14. SPECIFIC PERFORMANCE.

The parties hereto agree that irreparable damages would occur in the event any provision of this Limited Guarantee were not performed in accordance with the terms hereof by the parties and that money damages or other legal remedies would not be an adequate remedy for such damages. Accordingly, the parties hereto acknowledge and hereby agree that in the event of any breach by the Guarantor, the Guaranteed Party shall be entitled to specific performance of the terms hereof, including an injunction or injunctions to prevent breaches of this Limited Guarantee, in addition to any other remedy at Law or equity. The Guarantor (i) waives any defenses in any action for an injunction or other appropriate form of specific performance or equitable relief, including the defense that a remedy at Law would be adequate and (ii) waives any requirement under any Law to post a bond or other security as a prerequisite to obtaining an injunction or other appropriate form of specific performance or equitable relief.

15. MISCELLANEOUS.

(a) Each of the Guarantor and the Guaranteed Party agrees and confirms that the Original Limited Guarantee is hereby amended and restated in its entirety, and is in force and effect only as so amended and restated.

(b) This Limited Guarantee, together with the Merger Agreement (including any schedules, exhibits and annexes thereto and any other documents and instruments referred to thereunder, including the Equity Commitment Letters, the Contribution and Support Agreement and the Other Guarantees) contains the entire agreement between the parties relative to the subject matter hereof and supersedes all prior agreements and undertakings between the parties with respect to the subject matter hereof. No modification or waiver of any provision hereof shall be enforceable unless approved by the Guaranteed Party and the Guarantor in writing.

(c) Any term or provision hereof that is prohibited or unenforceable in any jurisdiction shall be, as to such jurisdiction, ineffective solely to the extent of such prohibition or unenforceability without invalidating the remaining provisions hereof, and any such prohibition or unenforceability in any jurisdiction shall not invalidate or render unenforceable such provision in any other jurisdiction; provided, however, that this Limited Guarantee may not be enforced without giving effect to the limitation of the amount payable hereunder to the Cap and the provisions of Sections 8 and 9 and this Section 15(c).

(d) The descriptive headings herein are inserted for convenience of reference only and are not intended to be part of or to affect the meaning or interpretation of this Limited Guarantee. When a reference is made in this Limited Guarantee to a Section, such reference shall be to a Section of this Limited Guarantee unless otherwise indicated. The word “including” and words of similar import when used in this Limited Guarantee will mean “including, without limitation,” unless otherwise specified.

(e) Each of the parties hereto acknowledges that each party and its respective counsel have reviewed this Limited Guarantee and that any rule of construction to the effect that any ambiguities are to be resolved against the drafting party shall not be employed in the interpretation of this Limited Guarantee.

[Remainder of page intentionally left blank]

| -9- |

IN WITNESS WHEREOF, the Guarantor has executed and delivered this Limited Guarantee as of the date first written above by its director or officer thereunto duly authorized.

| GUARANTOR | ||

| DONGFENG ASSET MANAGEMENT CO. LTD. | ||

| By: | /s/ Lu Feng | |

| Name: | Lu Feng | |

| Title: | General Manager | |

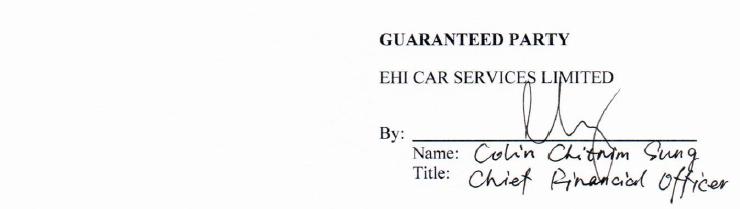

IN WITNESS WHEREOF, the Guaranteed Party has caused this Limited Guarantee to be executed and delivered as of the date first written above by its officer thereunto duly authorized.

SCHEDULE A

Other Guarantors

MBK Partners Fund IV, L.P.

L & L Horizon, LLC

The Crawford Group, Inc.

Ctrip Investment Holding Ltd.

Ocean Imagination L.P.